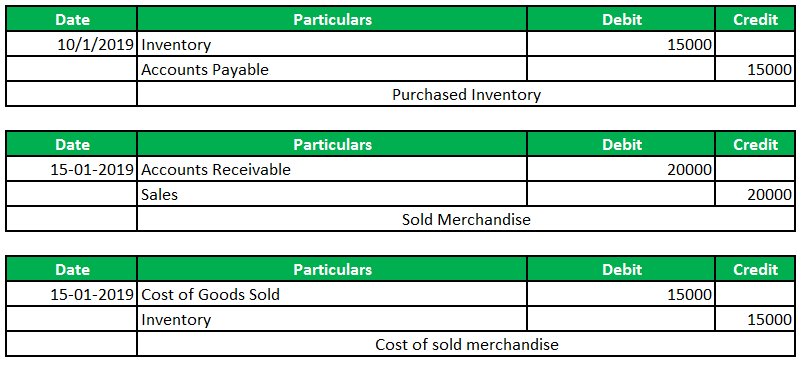

Journal entries for inventory transactions

Likewise, the inventory balances will be up to date and the company can review it anytime without making physical inventory count. Of cause, the company still performs the physical count of inventory sometimes for the control purpose. Inventory accounting journal entries are records in your accounting ledger that document your inventory transactions. There are different categories of journal entries, and the type and quantities of inventory you hold will determine the specific inventory accounting journal entry you use. Unlike the perpetual inventory system, there is no cost of goods sold account or the inventory account in the above journal entry.

- Establishing the cost of your ending inventory will depend on the inventory accounting method used to determine the cost.

- Inventory journal entries can include purchases of inventory, sales of inventory, inventory adjustments, and other inventory-related transactions.

- The company can also review and verify the inventory on October 12, 2020, by comparing the inventory in the account record with the physical inventory count.

- Every parcel that is delivered is first scanned, after which the balance is added to the current inventory levels.

- You will debit your COGS account and credit your inventory write-off expense account.

- Lower-of-cost journal entries are generally used when inventory has deteriorated, become obsolete, or if there has been a decline in market prices.

Explanation for Cash Purchase

Hence, the post-adjustment balance will be of lesser value than its prior book value. However, we can perform a physical inspection to evaluate the inventory condition to provide a proper estimate. It can be one of the methods that company uses, but it is not inventory counting.

End of Accounting Period Adjustments

When this inventory is purchased but payment will be made at a later date, the corresponding credit is made to the Accounts Payable to create the liability. The journal entry to capitalize the inventory and record the liability is as follows. Perpetual inventory system and period inventory system are the two methods of accounting for inventory that is different from one to another.

Would you prefer to work with a financial professional remotely or in-person?

This entry reflects the loss of inventory due to theft and reduces the inventory account accordingly. When the expense account has been debited, the amount spent on the now obsolete inventory is shown as an expense. The lower of cost accrual basis accounting vs cash basis accounting is compared to the original cost of your inventory and its current market price. Lower-of-cost journal entries are generally used when inventory has deteriorated, become obsolete, or if there has been a decline in market prices.

What is the approximate value of your cash savings and other investments?

That is why we need to estimate the expense and record it into an income statement before knowing the exact amount. In each case the periodic inventory journal entries show the debit and credit account together with a brief narrative. An inventory journal entry is a type of accounting entry that is used to record transactions related to a company’s inventory. Finished goods are the products that have completed the manufacturing process and are ready for sale. These are the items that a company holds in inventory awaiting sale to customers. Accounting for finished goods is vital as it directly influences revenue recognition and profitability.

However, even with such sophisticated equipment, perpetual records may be kept only in units, with the cost of ending inventories and goods sold determined by the periodic inventory system. Before the rise of digital technology, companies avoided perpetual inventory systems due to the time-consuming nature of the manual work involved. However, irrespective of the inventory costing method used, the conservatism principle of accrual accounting is what dictates the preparation of financial statements.

Debiting the Inventory account increases Garden Supplies Co.’s assets, as it adds value to the company’s stock. Crediting the Accounts Payable account increases the company’s liabilities, showing that the purchase will be paid for at a later date, not immediately impacting the company’s cash flow. The debit to the Inventory account shows an increase in assets, as the company now has more inventory. The credit to the Cash account decreases the company’s cash on hand, reflecting the payment for the inventory. SO the company always estimates the inventory write-down and records it into income statement.

This transaction does not have any impact on income statement and balance sheet. We do not record any expense as the company already estimate and record in the prior month. This entry deducts both inventory and inventory reserve, so it is not changing the inventory balance on the balance sheet. After this entry, Inventory balance equal to 480,000 (500,000 – 2,000) less 3,000 (5,000 – 2,000) which is 450,000. When actual inventory writes down incur, the company needs to make a journal entry by debiting inventory reserve and credit inventory. In the journal entry of inventory purchase, the difference between the perpetual system and periodic system is on the debit side.

Glass has a high rate of damage, so company needs to provide a proper reserve. The management needs to provide a high rate of provision for such kind of inventory as they have a high rate of loss due to damage or obsolete. Inventory only present $ 450,000 on the balance sheet as $ 5,000 was deducted by inventory reserve. On 31 Mar 202X, the inventory balance is $ 500,000, and management estimate inventory write-down of $ 5,000 which may cause by various reasons such as obsolete and damage.

Rather than asking employees to perform constant record-keeping, firms had more productive tasks for their workers. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.