Navigating Va Money Once Split up: Helpful tips for Veterans and you will Provider-Members

Split up is usually life’s most difficult challenges, especially for veterans and you may solution-professionals with already forfeited really operating on their nation. Amidst the fresh psychological and you will logistical whirlwind of breakup, one to extremely important planning very often appears is what goes wrong with an effective Virtual assistant loan just after breakup. In this guide, we’ll mention the particulars of Va finance about perspective regarding splitting up, bringing understanding and service for those navigating this cutting-edge terrain.

Information Va Money

First, let’s understand what an excellent Va loan is and why it holds value having pros and service-people. Va money try an invaluable benefit offered to whoever has offered on the armed forces, going for good small print for buying or refinancing a home. These types of fund is backed by the latest U.S. Agencies out-of Pros Products, providing loan providers provide competitive interest rates and you can requiring absolutely nothing so you’re able to zero downpayment, making homeownership alot more offered to the individuals who possess served.

Shared Virtual assistant Fund and Split up

Oftentimes, married veterans otherwise solution-members obtain Va money as you employing spouses to buy a beneficial home. not, when a married relationship ends in separation, the question pops up: what are the results into the Virtual assistant mortgage?

Generally speaking, Va loans commonly assumable, and therefore one-party you should never get along side financing immediately following the fresh split up. Instead, the borrowed funds need to be refinanced in the term of your own mate that will maintain possession of the house. This process relates to applying for another financing, that is in line with the person’s creditworthiness and you will economic updates.

Options for Approaching Va Funds Immediately following Divorce proceedings

Refinancing the mortgage: That choice is to the partner preserving control of the home so you’re able to refinance the brand new Va financing within name alone. This involves fulfilling brand new lender’s qualification standards and you will showing the knowledge to repay the loan centered on personal income and you will credit history. While you are refinancing can result in changes in rates and terms and conditions, it provides a clean crack in the mutual loan responsibility.

Promoting the house: Sometimes, offering your house is the really basic solution, particularly if none spouse wants to retain control or if it’s economically unfeasible for 1 people so you can re-finance the mortgage alone. Proceeds from the fresh new product sales are often used to pay-off new existing Va mortgage, and you will people left guarantee should be split depending on the terms and conditions of one’s divorce or separation settlement.

Negotiating Mortgage Presumption: If you find yourself Va funds aren’t assumable, there is hours where lenders are able to create exclusions, particularly if the divorcing people agree to including arrangements. But not, mortgage assumption was rare and you will at the mercy of the latest lender’s discernment.

Considerations and Challenges

- Creditworthiness: New partner seeking refinance the borrowed funds have to have sufficient creditworthiness in order to qualify for a different sort of home loan. This may wanted addressing one established debts or credit facts just before applying for refinancing.

- Economic Balances: Lenders assess the individual’s economic balances and you can capability to pay back the brand new financing on their own. Products like earnings, a job history, and you can loans-to-money proportion enjoy a crucial role about refinancing processes.

- Collateral and Assessment: This new guarantee in the home and its particular economy well worth was crucial activities into the refinancing or attempting to sell the property. An appraisal tends to be needed seriously to dictate the house’s really worth and you will ensure an equitable distribution out-of assets.

- Legal Factors: Divorce case get impact the section out-of assets, including the relationship domestic. It is essential to manage legal counsel so you can navigate the fresh legal effects off Virtual assistant financing refinancing and you may possessions ownership article-breakup.

Trying to Help and you will Pointers

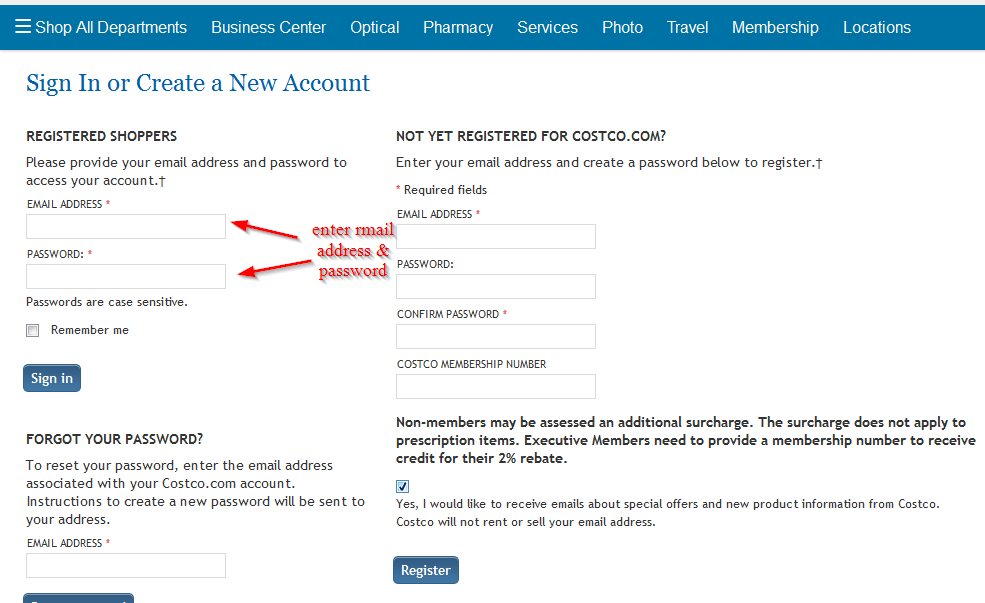

- Virtual assistant Mortgage Pros: Many loan providers focus on Virtual assistant loans and certainly will promote individualized advice and advice in the refinancing techniques.

- Legal services: Consulting with a knowledgeable nearest and dearest rules attorney might help clarify court rights and personal debt towards division off assets, in addition to loan places Echo Hills Va financing and you can homeownership.

- Financial Advisors: Economic advisors could possibly offer rewarding insights into managing finances blog post-split up, and additionally cost management, offers, and you will enough time-identity financial believed.

Separation is going to be a beneficial tumultuous travel, however, knowing the effects away from Virtual assistant finance and you may providing proactive measures will help veterans and service-members browse that it tricky terrain confidently. Whether refinancing the mortgage, promoting the home, or investigating solution choice, it’s necessary to prioritize communication, venture, and looking assistance out-of experts who see the book requires out of army parents.

Once the path submit may seem challenging, just remember that , you’re not alone. Of the leverage the latest resources offered and you may handling the procedure that have persistence and resilience, veterans, service-participants, in addition to their families can browse the changeover with elegance and you will emerge more powerful on the reverse side.

Since travels may possibly not be effortless, experts, service-users, in addition to their household hold the resilience and you can dedication to get over demands and build a brighter upcoming, one-step at once.