3modification out-of end up in africa and you will present scholarship toward Ghanaian belongings places

Two legislative treatments based on possessions series and you can landholding responsibility with the accessibility residential property of the private loved ones is critical for our very own research. This type of treatments through the Intestate Series Legislation 1985 (PNDCL 111) plus the Head regarding Family unit members Liability Laws 1985 (PNDCL 114) , having potential benefit in order to house accessibility, in addition to also on amount of the tiniest family members device. Within arrangement, control of the home reverts regarding private control (of your own ily as a corporate equipment . noted one to no individual can allege sole control to particularly a homes. It is not argued when your family functions as an excellent collective cluster, the household unit additionally the belongings stored by friends once the commonwealth could be used given that buffers up against exhausting changes [75,76], plus making it possible for a member to utilize this new house since the collateral shelter to own money. In this situation yet not, it’s important so you’re able to discuss the criterion and requires each and every cherished one [77,78].

Considering the separated reputation towards implications off property period membership courses from the books essentially, it paper seeks to present knowledge throughout the Dagbon societal program within the Ghana so you can explicate the issue on the ground. That it employs regarding realisation one to inconsistencies had been well-known into the the fresh transformation books [79,80], with ramifications for how programs getting regional belongings registration work well in different societal structures. In this regard, examining how stars within this various other societal possibilities get excited about property tenure subscription programmes additionally the ramifications of their engagement could be beneficial. The newest core attract from the papers are for this reason to understand more about the newest character and you can fictional character out of metropolitan assets segments throughout the Dagbon city inside the northern Ghana, and just how they food in making use of certain property-based funding tool. Especially, we concentrate on the skill off landed property to incorporate availability in order to borrowing and you may money financing on the houses program.

cuatro.step 1. Data city dysfunction

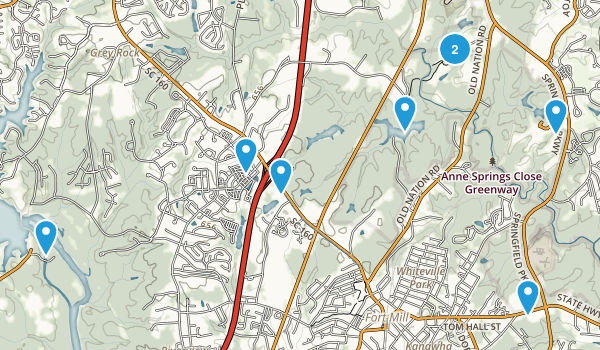

The research is held from the Tamale Urban Town (TMA) (find Fig. step 1 ). Tamale is the local capital of your own Northern Area for Ghana. This new indigenous folks of Tamale are definitely the Dagomba cultural category and therefore for hundreds of years shaped among the many earliest kingdoms in your community named Dagbon, with its conventional Overlord into the Yendi. Tamale, the principal city of the new Dagombas, ‘s the 3rd-biggest area inside Ghana and an evolving hotspot getting funding inside the Western Africa. Tamale functions as the administrative and you can industrial centre into the Northern Region also increases once the higher metropolitan, economic, social, governmental, and you will monetary financial support of the North Region (get a hold of Fig. step 1 ). The city hub out of TMA hosts several local, regional, and in the world finance institutions and various in the world and you can local nongovernmental enterprises. Dagbani ‘s the indigenous code away from Dagbon.

To conquer so it issue, new literature means that a lasting casing financing method is vital [, , ]. Including a business is also significantly more requiring in the International Southern places such as Ghana, where emigration to the urban centers has actually overrun casing facilities, causing sprawling slums [thirteen,14]. Even in the event available borrowing from the bank possibilities enjoys basically been regarded while the a good driving force within the making certain green homes strategies, various things about the fresh restricted circulate off lender borrowing so you’re able to house and providers might have been a design in numerous research studies within the this type of places. Into the Ghana the situation could have been duly recognised. Aryeetey observed the fresh discrepancy involving the resistance away from financial institutions so you’re able to generate credit available given that domiciles and you will companies largely run out of sufficient acceptable collateral to help with their money. Offered statistics demonstrate that, in the Ghana, an estimated 79% regarding small and you may 83% away from small-level enterprises are credit restricted, compared with 62% and you may 68% correspondingly from inside the Malawi (ibid.:164). Therefore, when you look at the a breeding ground in which potential people use up all your guarantee to support borrowing from the bank to invest in property strategies, individual coupons, offering out-of assets, and you will remittances regarding members of the family abroad are a portion of the-sit out of capital having individual housing framework and you may orders [12,16]). Because of the useless loans increased from all of these source, more often than not it requires more a decade doing the latest design of 1 possessions [twelve,17].

cuatro. Material and techniques

The job off lends support to that particular approach. One of most other methods ,talks about the Government out of Turkey functioning property financialisation because of new legislation; performing monetary frameworks one improved speculation by the home-based and you will globally investment on residential property and homes since the possessions; enclosing personal property Missouri title and loan and you will exploiting everyday version of tenure; to make property out-of home and you will homes because of the developing money-discussing metropolitan regeneration plans; and ultizing coercive courtroom and you may penal force so you can outlaw casual innovation, also to prevents effectiveness county-contributed advancement jobs.

Just what appears lost within the earlier in the day training might have been the fresh mini-height, implications off friends-let mortgage preparations, in addition to having fun with intra-family relations house because the equity inside getting loans for investment. Actually, for the custoily-let home loan plan are a method that has been useful ages from inside the antique sectors in Ghana during times of individual or relatives you desire. Even after the fresh promulgation of your Intestate Succession Rules, 1985 (PNDCL step 1 111) , sense signifies that Ghanaian group will most likely not proceed with the terms regarding the Intestate Law when controling brand new care about-acquired possessions out of a deceased dad, fearing it might dissipate their house . Certain family like staying the property during the a share on the entire friends, especially in the actual situation away from land. This will be particularly the circumstances in the event that bit of possessions bequeathed is fairly small and don’t be easily shared but from the offering the property and you can distributing new proceeds. However, posting particularly property is problems from inside the northern Ghana, in which Total Fertility Price are high, and you will polygyny ‘s the norm . Polygynous equipment with various uterine group mean a high reliance ratio. The chance you to definitely fragmentation of the house this kind of issues you may devalue the economic benefits prompts family members to store for example assets when you look at the the brand new pool. The latest advent of authoritative financial reinforced brand new customary use of for example property.

Next angle, brand new and you may, afterwards , analyses out of property are foundational to field ideas within support to your individualisation from possessions contained in this ethical limits . Such theories preceded those people arguing the latest sheer inevitability out of individualisation due to the fact better because those people towards economic advisability out-of individualisation. These are, not, opposed to common assets theorists that do perhaps not look for individualisation as the a catalyst to possess invention.

It is also obvious regarding the literary works analyzed that, even though loads of scholarly performs has been done to your the subject of belongings once the equity, there’s hardly any work particularly looking into intrafamily quick systems (and polygynous household having uterine equipment) and how the aid of the new commonwealth is actually negotiated into the support of people looking to use this friends property because the collateral to have fund. Among other factors, the objective of this study for this reason will be to speak about the fresh new ins and outs about negotiation of one’s commonwealth given that security for folks, how this can be shown, and you will what the results are in case there are standard of financing commission and what is actually completed to retrieve the newest told you possessions.