Best Build Loan lenders out of 2023 – Investopedia

Wintrust Mortgage. Wintrust Financial is amongst the better 20 bank-possessed merchandising financial. Repaired interest rate financing choices. Versatile structure words. Knowledgeable and knowledgeable mortgage lenders. Financial support to possess remodeling and you will enhancements, in addition to new home structure. Underwriting behavior are formulated in your area, increasing the brand new approval process. To find out more about home-based Design Loans, call us during the (847) 586-2401. Construction-only loans, known as “two-close” build fund, must be repaid if the strengthening is finished. This new funds require the debtor to qualify, get approved and spend.

Wisconsin; Elkhorn; Construction Finance (most recent page) Category: Build Finance Appearing: 248 results for Construction Fund near Elkhorn, WI. Sort. Length Rating. Filter out (0 productive) Filter of the. Financial support available for an effective nine day speed from the dos.49% and you will cuatro.643% Annual percentage rate centered on $3 hundred,000 financing that really needs 8 monthly attract money between $ in order to $ and something balloon percentage out of $300,. Give relates to proprietor-occupied unmarried tool residential structure, restrict 80% loan-to-value. Property should be situated in Dane State. Contact: Doug Brownish, Douglas.B, 715-966-0157. Condition Forest Adjustable Acreage Express Financing. Qualifications & Purpose: Counties which have countries enrolled in brand new Condition Tree Legislation are eligible to apply for attention-free financing for usage towards the get, innovation, maintenance and maintenance from State Tree countries. Plans must be.

Virtual assistant Structure Finance | LendingTree.

Financial support designed for a beneficial 9 month price from the 2.49% and you may cuatro.643% Apr centered on $3 hundred,000 loan that needs 8 monthly attract money between $ to $ and another balloon percentage out of $3 hundred,. Offer relates to owner-occupied single tool home-based structure, maximum 80% loan-to-value. Assets have to be based in Dane County. House Dependent Financing provides the best the newest structure funds to possess a property traders, giving difficult currency build funds anywhere between $100K to $step three.5M to have residential and blended-have fun with qualities during Wisconsin. We concentrate on closing income quickly, which have financing recognition as fast as twenty four hours and you may average contract closing into the 10 months or faster. A casing loan will be the right mortgage if you’re strengthening a home. It’s often required because of the offered period of time and unique needs regarding the building processes. Below are brand new construction now offers: 2 month price secure to possess repaired and you may changeable rate mortgages Option for approximately 180 date speed lock to own repaired price mortgages.

Post and Material Body type Mortgages – The fresh Century Financial.

We offer a good amount of construction money made to match almost all of the new house build you need. When you’re currently a citizen, you might contemplate using brand new equity on your own existing domestic to invest in your brand new domestic framework venture. Get in touch with all of our educated home mortgage officers to possess assist choosing the road that’s best for your specific need. Award winning Local Financial Prompt [One-Time Intimate USDA Structure Finance] 100%, Zero Down USDA Outlying Home loans. Phone call (844) 999-0639 Today. Hero. New york, –VICI Services Inc. (NYSE: VICI) (“VICI Attributes” or even the “Company”), an experiential investment trust, announced today your Business has wanted to.

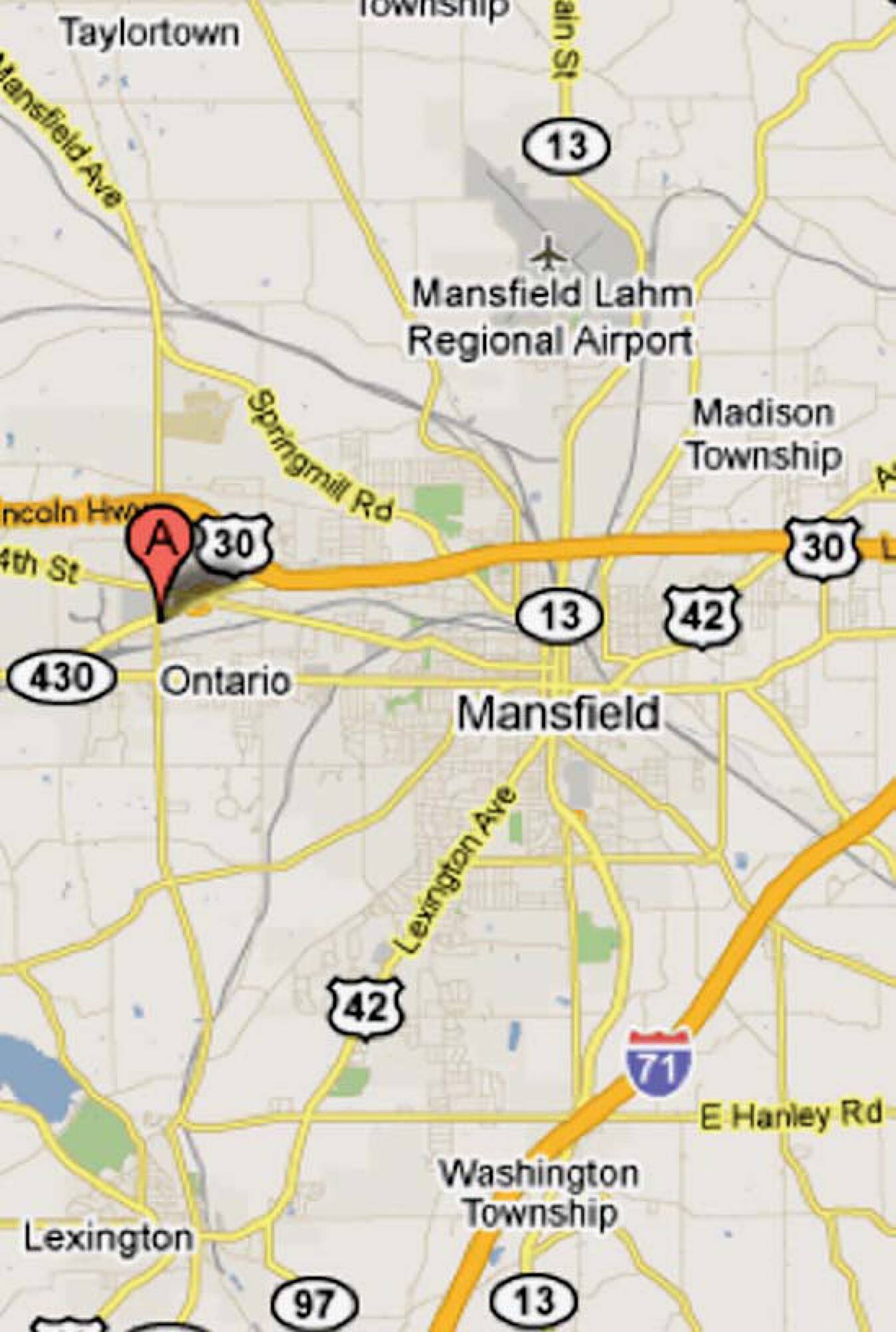

Our Metropolitan areas | GreenStone FCS.

A housing mortgage is actually a short-label mortgage designed to advice about the purchase out-of a story out of home therefore the design out of a home otherwise purchase big renovations to help you a preexisting house. A builder otherwise. Nexa Mortgage, the biggest mortgage broker in the united kingdom, has actually basic the procedure of searching for the correct lender to possess you and your family members’ dream house. Assist we during the Nexa help you find just the right mortgage, whether it is a secure and you can home loan, a produced domestic framework mortgage, or financing for the this new or used facility-based domestic. We did our browse and found that it’s you’ll to help you fool around with a Virtual assistant Loan for financing a good barndominium check my site structure. However, do not suggest it for many factors. First, truth be told, Virtual assistant financing was issued from the local and federal banking institutions, perhaps not new Agency regarding Pros Affairs. In which the Va is available in is by guaranteeing the newest financing.