And make a great Fidelity 401(k) detachment before ages sixty need a past hotel

You won’t just shell out taxation punishment in many cases, but you’re in addition to robbing on your own of your own astounding advantages of compound desire. This is why it’s so vital that you care for a crisis money to cover any brief-term currency needs without charging your self more through an effective 401(k) early detachment.

Although not, lives has actually a means of throwing your curveballs which could leave your having pair to hardly any other selection. For those who really are in the a financial disaster, you could make a detachment for the basically the same way while the an everyday withdrawal. The proper execution is actually done in a different way, but you can find it to the Fidelity’s site and request an effective single lump sum otherwise multiple arranged money.

For individuals who jump the gun, even if, and commence and come up with distributions prior to the ages of 59 step 1/2, you have basically damaged the pact to the bodies to expend one money to the retirement. As such, you’ll spend income tax penalties that can reduce their nest egg before it extends to you. An effective 401(k) very early withdrawal setting a taxation penalty out-of 10% in your withdrawal, that is on top of the regular tax assessed on the the money. If you are currently generating an everyday income, your early detachment could easily force you on the a higher income tax bracket but still feature one most punishment, so it’s a very high priced detachment.

401(k) Adversity Withdrawal

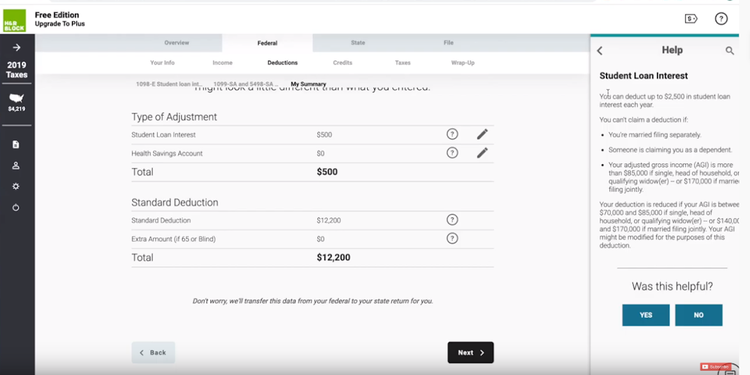

You’ll find, although not, a number of different points for which you is avoid you to definitely most income tax penalty. New Irs allows for good 401(k) difficulty withdrawal in certain situations instance a health disaster or even to purchase funeral service costs, whenever your qualify, you can nevertheless shell out https://paydayloancolorado.net/weston/ typical income taxes into currency however, no even more punishment.

There are some almost every other unique exclusions that will allow your and also make an early on withdrawal without paying a lot more taxation in this specific constraints, along with buying expenses or purchasing your earliest family. Speak with a great Fidelity user before making a detachment to help you be sure you aren’t using any so many penalties.

If you are planning and also make a hardship detachment, you should anticipate to promote facts in order to Fidelity. Lower than are a record of your own data files you will need:

- Fidelity withdrawal forms: You’ll need to bring certain facts about your bank account.

- Bills of your own will set you back causing your adversity: An invoice of a funeral service house otherwise builder taking an essential house fix would-be sufficient evidence of debt difficulty.

Advancing years Thought Ramifications

If you’re facing a monetaray hardship you to forces that capture funds from your own 401(k) prematurely, it is critical to read this may has a bad affect the much time-title later years agreements. When you pull fund from your own membership, you are cutting short their possibility to build more than your career. Manage new number to see exactly how this hit on financial support accounts you are going to feeling your retirement nest-egg. In many cases, pulling-out money very early is a significant drawback on your own later years planning.

Solution Financing Solutions

- 401(k) loan: An excellent 401(k) financing using Fidelity allows you to acquire some funds from your 401(k). In general, you will have to pay the mortgage within this five years.

- Domestic collateral loan: A property guarantee mortgage enables you to make use of the value of your property guarantee. Even in the event you will have another homeloan payment, you could potentially log off retirement fund untouched.

- Personal loan: An enthusiastic unsecured consumer loan helps you get the funds your you would like versus a beneficial 401(k) withdrawal otherwise making use of your house equity. So it adds a fees to the monthly obligations. Nonetheless it can help you coverage a large upfront costs.