The new Single Foremost Backup to keep on your Bargain

For the scorching areas particularly Bay area or Ny, customers usually have to visit the other mile and make its promote be noticeable. Some buyers promote considerable off repayments, other people establish strategic promote characters , some even shed snacks in the door.

Plus markets in which numerous also offers will be the norm, it isn’t unusual in order to waive contingencies, which offer people the authority to right back regarding contracts not as much as certain affairs.

However so fast. . .If you’re removing a contingency could cause a faster purchase and become attractive to a supplier, you might find on your own buying eliminating unnoticed black shape throughout the attic otherwise absorbing the cost of a lowered cherished appraisal . At the same time, for many who tie-up a binding agreement with so many what ifs, the seller is far more likely to refute the give because of offer waits, dangers, or prospective will cost you they pushes these to bear.

Some contingencies be much more essential as opposed to others to provide. Buy contract contingencies is associated with the last cost of a good deal and include consumers from the largest unexpected fees. Immediately after which you’ll find level-several contingencies, including a property owners connection clause which can help you pull out off a purchase in the event that you will find unanticipated regulations (such as for example not being able to decorate your residence a particular color).

The bottom line : Keep promote protected against the erratic and you’ll be ready simply to walk out of the bargain instead dropping any money. But in a hot field that have multiple has the benefit of , believe deleting this new reduced very important of those. Listed below are five crucial contingencies to store in your offer, and you may arguably the initial one lower than.

Check backup

Property examination backup – highly recommended from the really real estate professionals – determine that you get an authorized house inspector to evaluate the home inside a selected period (usually 1 week) after you indication the acquisition arrangement. As evaluation is complete, you will be permitted to demand that merchant renders solutions elitecashadvance.com/loans/10000-dollar-payday-loan/, and it’s your responsibility to determine exactly what repairs your consult. Owner following gets the substitute for result in the repairs otherwise counter. If the a binding agreement cannot be achieved, people can be back from their pick making use of their earnest money put undamaged.

Funding backup

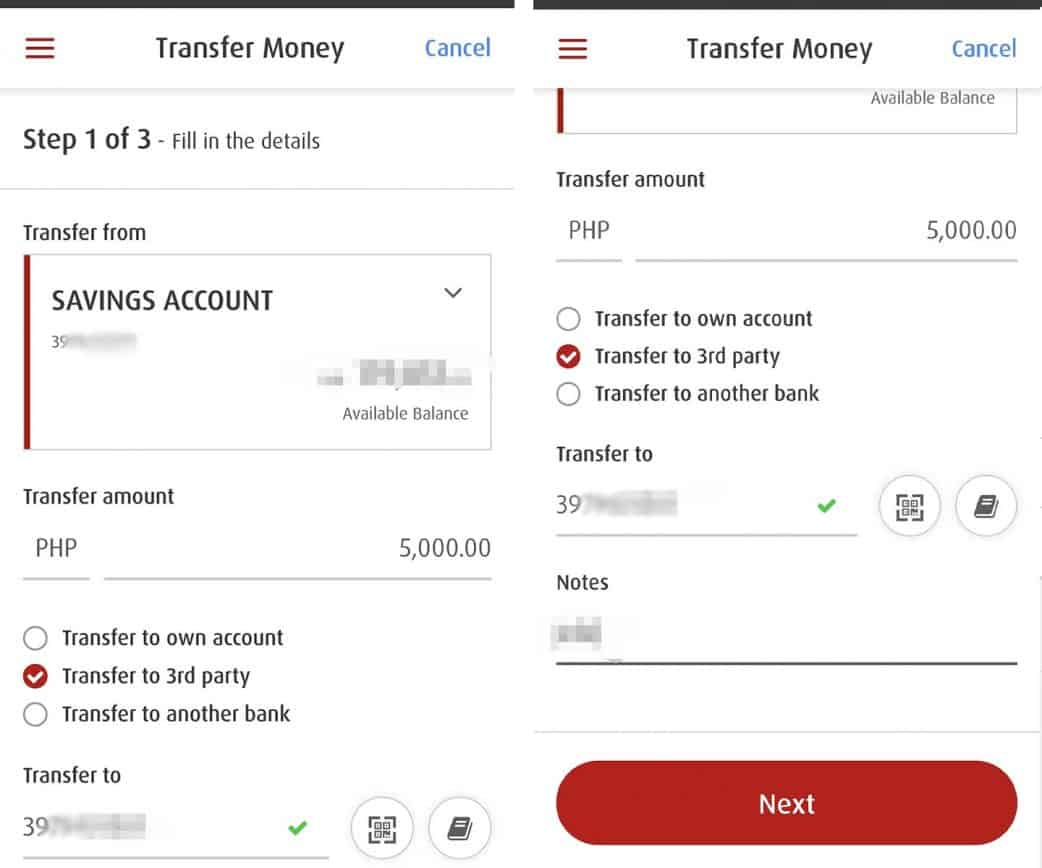

Which clause says that your particular promote on the property is contingent on the having the ability to secure money. An element of the purpose of a funds contingency is always to guarantee that if you’re unable to see that loan, you can get your earnest currency deposit back. The fresh new clause specifies which you have a certain number of weeks in this and this to really get your mortgage approved by their bank. Many loan providers recommend homeowners accommodate up to 2 weeks.

House-selling contingency

Of a lot people need to have the equity within latest the home of get an alternate that. So it contingency means if for example the purchases regarding a client’s most recent home drops compliment of, therefore tend to the purchases of the property the consumer would like to buy. As well as a past-profit contingency in the offer to suit your brand new home brings a keen possible opportunity to withdraw the offer should your present family will not offer by the a specific go out. If you need to offer a preexisting house before buying a different sort of one to, it is yes a solution to believe; but not, be cautioned it is as well as one which has been recognized to scare away manufacturers.

We protected one to own last: Brand new assessment contingency

That it backup is actually arguably the first because it will save you as much as tens and thousands of cash. Generally, once you purchase property, you spend an offer, while the seller accepts it, your lender requests an appraisal. If the appraisal comes in below the cost you provided to shell out, you should have some conclusion and work out – mainly steps to make in the difference in the home rates additionally the loan amount. You will have much more possibilities if you’ve integrated an appraisal backup . Particularly a contingency always stipulates that the assessment need are located in in this 5% otherwise ten% of your own marketing rates, or occasionally during the or above the business price. You can consider to negotiate with the provider to satisfy you midway, however with it contingency, it’s your name to decide whether you are overpaying with the possessions and wish to back out.