Evaluate Your options for money Distributions and Money

Overview

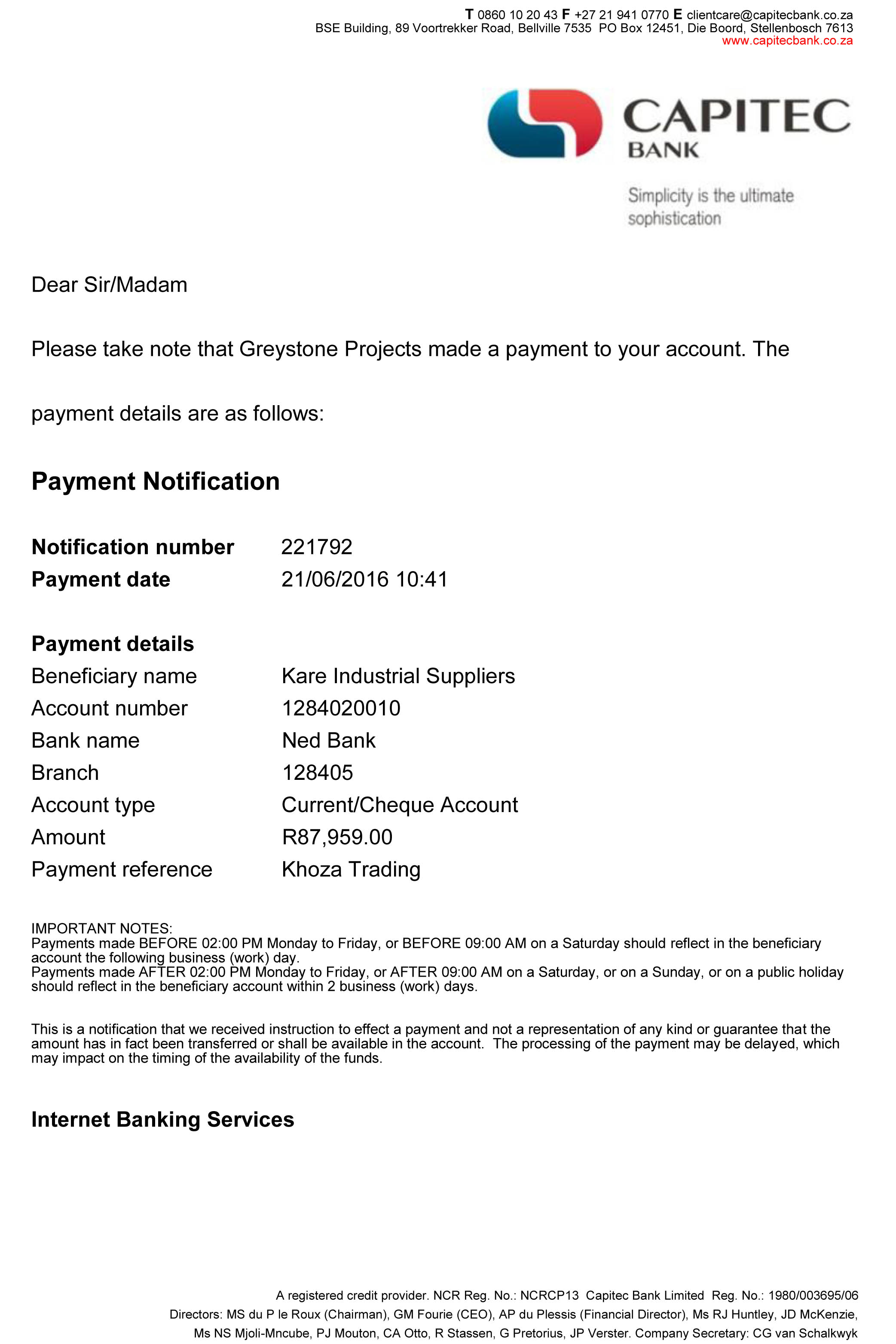

The capability to bring a cash withdrawal otherwise financing from your own U-M later years discounts plans depends on a great amount of facts as well as the program variety of, how old you are, the reason behind withdrawal, and if you’re a recent worker, a former worker or U-Meters retiree. In many cases you happen to be susceptible to fees and you can penalties. Talk to a taxation elite group or financial coach and get inquiries you comprehend the restrictions, requirements and you can outcomes before you take people step.

Simple tips to Initiate a money Detachment

- TIAA: 800-842-2252, Tuesday – Monday, 8 a great.yards – ten p.m. (ET)

- Fidelity: (800) 343-0860, Tuesday – Tuesday, 8 an effective.yards. – midnight (ET)

2. A telephone affiliate commonly review your bank account to see the total amount readily available for a withdrawal, whenever you are qualified to receive one to.

3. Bring verbal tips more a recorded line to help you start brand new withdrawal. This is quicker and more effective than doing and emailing good papers mode to TIAA or Fidelity.

After the are overviews of one’s options for while making withdrawals or finding loans of for every plan type. To have info, select Qualification and functions for the money Withdrawals and you will Money.

At the decades 59? otherwise earlier, if you’re rehired on the a career term that isn’t permitted take part in the essential Old age Package

Another occupations titles are not permitted join the brand new First Old age Plan and will grab an earnings withdrawal or rollover at age 59? or older as good rehired retiree otherwise rehired previous professors otherwise staff member:

- Temporary each hour

- Emeritus and emeritus which have money

- LEO We and Adjunct forty-two% energy otherwise reduced

The following work headings qualify to enroll regarding the Basic Later years Bundle and cannot get a money detachment otherwise rollover in the all ages since an excellent rehired retiree otherwise rehired former faculty otherwise staff member:

Qualification and functions for money Distributions and you will Funds

Following is information regarding when you can get be eligible for that loan from your own U-M later years agreements, when you can get be eligible for a cash detachment, and also the tips to request financing or bucks withdrawal.

Eligibility

- Very first Retirement Bundle Zero loans are available anytime.

- 403(b) SRA You’ll be able to acquire to fifty% out of your 403(b) SRA any moment, unconditionally, whether or not your a career is productive or ended. Yet not, financing are not made available from TIAA after you’ve retired or ended a career out of You-Yards.

- 457(b) Deferred Compensation Plan It’s also possible to acquire up to fifty% out of your 457(b) at any time, for any reason, it doesn’t matter if your own employment is actually productive or terminated. But not, fund are not available from TIAA after you’ve resigned otherwise terminated a job from You-Yards.

Amount borrowed

Minimal amount borrowed are $1,000 and the restriction was $fifty,000. This is exactly a combined financing limit and you may applies to each one of their You-Meters 403(b) SRA and you can 457(b) profile having both vendors. New $50,000 financing limitation was faster because of the highest a fantastic financing balance toward most other plan money inside earlier one to-seasons several months. The utmost mortgage is additionally reduced by one an excellent finance your possess which have TIAA and Fidelity.

Additionally, the most quantity of loans you’ve got which have TIAA anywhere between the 403(b) SRA and you will 457(b) are around three. It restriction doesn’t connect with fund which have Fidelity. You may want to continue to participate in the brand new U-Yards Senior years Deals Plans by using financing away from possibly plan.

Tax-deferred vs. After-taxation Roth Finance

TIAA cannot bring 403(b) SRA otherwise 457(b) money to the shortly after-taxation Roth number. Fund are available just towards income tax-deferred number with TIAA. Fidelity possesses the capability to borrow money with the each other tax-deferred and you may loans in Twin just after-taxation Roth amounts toward 403(b) SRA and 457(b).