What is a keen FHA Refinance? And what are the positives and requirements?

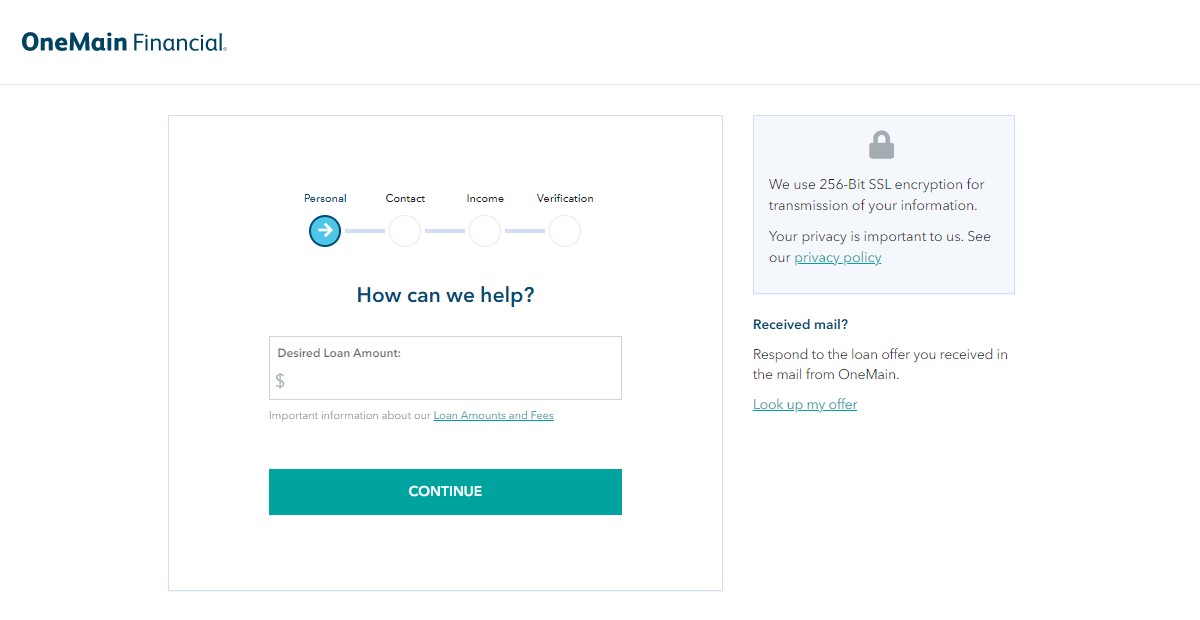

Questions about brand new FHA program conditions or pre-acceptance? So you’re able to expedite your demand rapidly, excite fill out the latest brief suggestions consult means in this post, seven days a week.

If you are looking to help you re-finance another kind of mortgage loans eg Virtual assistant, USDA, otherwise Old-fashioned, please submit the data Request Form for additional info on refinancing selection.

On this page

- What exactly is a keen FHA refinance mortgage?

- Why submit an application for an excellent FHA refinance?

- How come an enthusiastic FHA home mortgage refinance loan works?

- Exactly who qualifies to own FHA refinance?

- Type of FHA refinances loans

- FHA Cash out Re-finance

- FHA (Government Property Management) Streamline Refinance

What’s a keen FHA home mortgage refinance loan?

New FHA mortgage system has been very popular than ever the latest recent years because the borrowing from the bank happens to be more complicated to acquire. FHA finance are one of the ideal available options to have borrowers that would wanna re-finance the mortgage to acquire a much better contract or even to pay off personal debt. FHA finance are known as a simple mortgage in order to be considered owed into flexible borrowing from the bank assistance additionally the lower security requirements. Taking FHA funds is actually prominent having home buyers who had been thanks to a financial credit event such as for instance a short sale, foreclosures or other pecuniary hardship along side longevity of the borrowed funds before and therefore are trying to get their finances straight back on the right track.

As to the reasons apply for good FHA re-finance?

FHA re-finance programs are designed to help borrowers which have established FHA financing all the way down its monthly mortgage repayments or availableness equity inside their house. Check out reasons why you can thought obtaining an FHA refinance:

Straight down Interest levels: One of the primary reasons to re-finance a keen FHA loan was when planning on taking benefit of lower interest rates. If the industry interest rates keeps fell as you initially gotten the FHA financing, refinancing makes it possible to safer a separate financing having a lower life expectancy interest rate, potentially cutting your monthly installments.

Less Monthly installments: From the refinancing the FHA mortgage, you will be capable continue the loan label, ultimately causing straight down monthly home loan repayments. This can be particularly of good use whenever you are up against economic challenges or should alter your earnings.

Transfer away from Adjustable Rates so you can Repaired Rates: When you have an enthusiastic FHA changeable-rate home loan (ARM) and are also concerned about ascending interest levels, you could refinance to a fixed-rates FHA mortgage to add balance in your monthly payments.

Cash-Aside Re-finance: FHA also provides bucks-out re-finance choice, enabling you to make use of your house collateral. This is certainly employed for and make home improvements, paying highest-focus personal debt, otherwise level tall costs, such as for example degree or scientific debts.

Streamline Re-finance: The newest FHA Streamline Re-finance program was a basic procedure designed to succeed more relaxing for established FHA consumers in order to refinance their financing. It requires smaller files and can continually be completed with limited borrowing from the bank and appraisal criteria, therefore it is a handy choice for those individuals looking to lower the interest rates otherwise monthly installments.

Debt consolidation: If you have high-focus debts, such as for instance bank card balances otherwise signature loans, you are able to a keen FHA bucks-away re-finance so you can combine this type of debts into the a single, lower-interest financial, potentially helping you save money.

Home loan Insurance premium Cures: Depending on when you received your FHA financing, installment loans Clearview WA the mortgage insurance premiums (MIP) you have to pay can be greater than the current cost. Refinancing their FHA loan could possibly get enables you to lower your MIP payments.

Home improvement: FHA now offers 203(k) recovery money which can be used to finance home improvements whenever you refinance. This is exactly instance of good use if you would like buy a beneficial fixer-top and come up with called for fixes otherwise updates.