Ought i fool around with financing to blow fees?

Solutions become a property guarantee mortgage, a personal bank loan otherwise drinking water investment protected resource, for every single using its positives and you will dangers.

You don’t need to much choices in terms of paying fees. However, you do have selection on precisely how to pay them. Writing a is certainly one method, however in some cases, it may not be the best financial approach. You will be in a situation in which borrowing the money can get feel a much better alternatives.

Deciding on all of the potential choice helps you go your goals, claims David Mook, captain personal banking officer at You.S. Bank Riches Government. That is the truth if you have an abnormally highest taxation accountability due to a giant taxable knowledge, eg attempting to sell a pals otherwise a secured item you to definitely incurs funding growth, or you pay only much in taxes annually. The us government mandates when fees is due, but one big date will most likely not generate financial sense to you. Using borrowing can give you freedom and you will command over when you should liquidate an asset otherwise assembled the bucks.

When you’re happy to think personal debt to expend their taxes, listed here are around three types of money you could use to spend taxation.

The us government mandates whenever taxes was due, however, that go out may well not make monetary sense for your requirements. Using borrowing from the bank can present you with independence and you will control over when you should liquidate a secured item otherwise come up with the money.

step 1. Domestic security mortgage to pay fees

If you very own a home or vacation property, you could potentially make use of the security by firmly taking aside a loan otherwise line of credit to blow taxes.

One to downside would be the fact these types of loan may take particular time to install, once the financial will have to appraise your residence and you may prepare yourself name work. You can also getting energized initial will cost you that could include an enthusiastic appraisal fee, credit file commission and you will financing origination payment. And you can rates can be higher than a few of their additional options.

Shortly after consider the advantages and you will downsides, Mook claims house equity money are ideal for some people. Many people are most comfortable with personal debt on the household, according to him. Just about everybody has or has received a mortgage. This may be a hotter options than other options.

2. Consumer loan to pay taxes

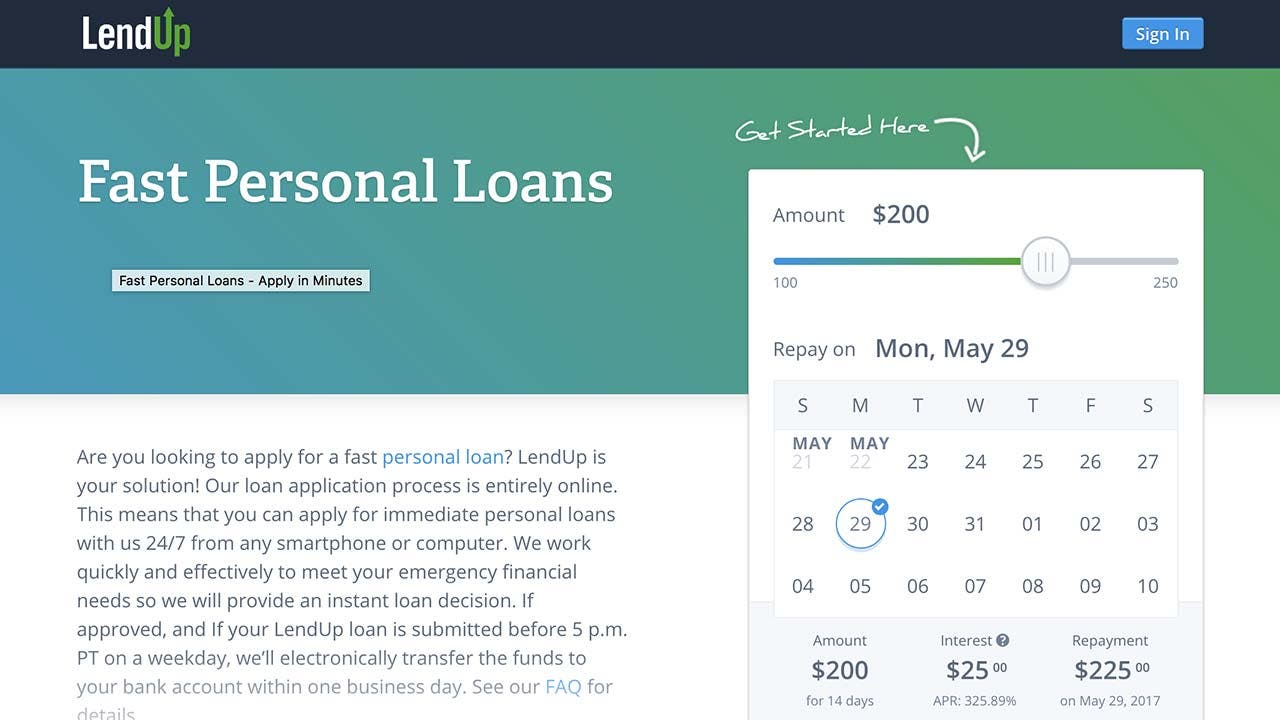

If not must put your household right up once the collateral, an alternative choice try a personal bank payday loans in Alabaster AL no credit check loan to spend taxes. The advantage to this brand of funding is actually time. Unsecured loans are shorter so you can safer than just a house security loan.

Unsecured unsecured loans tend to be the costliest cure for use, although not. Given that you are not providing the bank any security, the borrowed funds will bring a higher interest rate. Unsecured loans may also have a whole lot more limitations, such a shorter repayment title otherwise shorter credit limit.

Signature loans additionally require detailed monetary revelation, eg individual monetary comments and past tax returns, states Mook. The new underwriting processes is a little a bit more in depth for signature loans.

step 3. Liquid resource safeguarded money financing to pay fees

A 3rd option to shell out taxation is drinking water investment covered financial support, which involves pledging their profile from marketable securities to help you safe good credit line. The quantity you can secure is bound with the matter your own portfolio is service. There are not any can cost you otherwise costs to have setting-up a line regarding borrowing from the bank, hence sorts of borrowing comes with no needed dominating repayments. Consumers are merely required to spend the money for monthly notice charges.

This is the most affordable means to fix borrow, since the interest rates was lowest, states Mook. You could borrow funds and you will pay it off mostly just in case you would like. If you acquire $fifty,000, such as for instance, you are able to only pay the eye into the $50,000 for as long as it’s outstanding. You don’t have to afford the $50,000 right back up to you are able, of course there is not a decrease on the market which causes a good margin name.

Resource the goverment tax bill could help you stop undertaking another nonexempt event, such as the financing growth you incur whenever attempting to sell a sellable security who may have preferred inside the really worth. Your own collection may grow faster compared to the appeal you will end up charged, deciding to make the price of attract an even more attractive choice.

Liquid house secure resource is also the fastest version of borrowing. A column could be used in place in a matter of days. I tell visitors to get them install well just before date, because the then it is a phone call in order to borrow cash and also you have money the same go out, states Mook.

The brand new disadvantage because of it kind of loan is the fact it’s tied towards field, which is unpredictable. In case the worth of the ties put once the security falls lower than a certain endurance, you may need to pledge extra bonds otherwise pay down the mortgage. Otherwise, the lender you can expect to offer particular or all the ties.

Prepare for Taxation Date of the talking to your own income tax advisor and you can financial top-notch to know their tax liability and you may dangers in order to create arrangements to own fulfilling them in a way that best suits your financial needs. Borrowing money is just one economic device having paying your own taxes, and ultimately the option is perfectly up to you. On one ones about three variety of fund to settle taxation can make experience to you this present year, otherwise later on down the road.