Very in all the newest surveys, mathematics, and you will statistics, 90% of everybody which have education loan debt will pay it back just fine

And is what is actually going to make those individuals experiences for your requirements. Then after you don’t know and you may falter, plus workplace demonstrates how to get it done, that sort of point. That is how you get ideal during the these types of most beneficial soft knowledge at work.

SHERYL: While discover Really don’t along these lines, anyway. This is simply not the things i need to do on the people off my entire life.

ROBERT: Sure, but men and women event transcend, right? Including, perhaps don’t want to work with eating provider the lifestyle. High. Nevertheless idea of dealing with a customer timely and you will speaking to them, searching people regarding the vision, maybe to make particular small talk, those skills just transcend every single employment long lasting.

SHERYL: Yeah, delicious. Great. Thus i often ask you a question I most likely should be aware of the answer to but do not learn. Thus pupil obligations we- what’s the reason that it turns out getting so difficult to possess them to pay off?

The situation that have education loan debt would be the fact people don’t read the brand new equity of the money can be your money

ROBERT: It isn’t while the hard, I do believe, since the anyone depict it. No-one enjoys it. No one wants for the debt. Eg, let’s be real here. For those who provided me with the choice to not have they, I’d choose not to ever want it, but if you go through the math, 90% of everyone has been paying off they.

Today there is the brand new 10 percent one really does struggle with it. Particular People in the us getting anything don’t work away even with student loan personal debt.

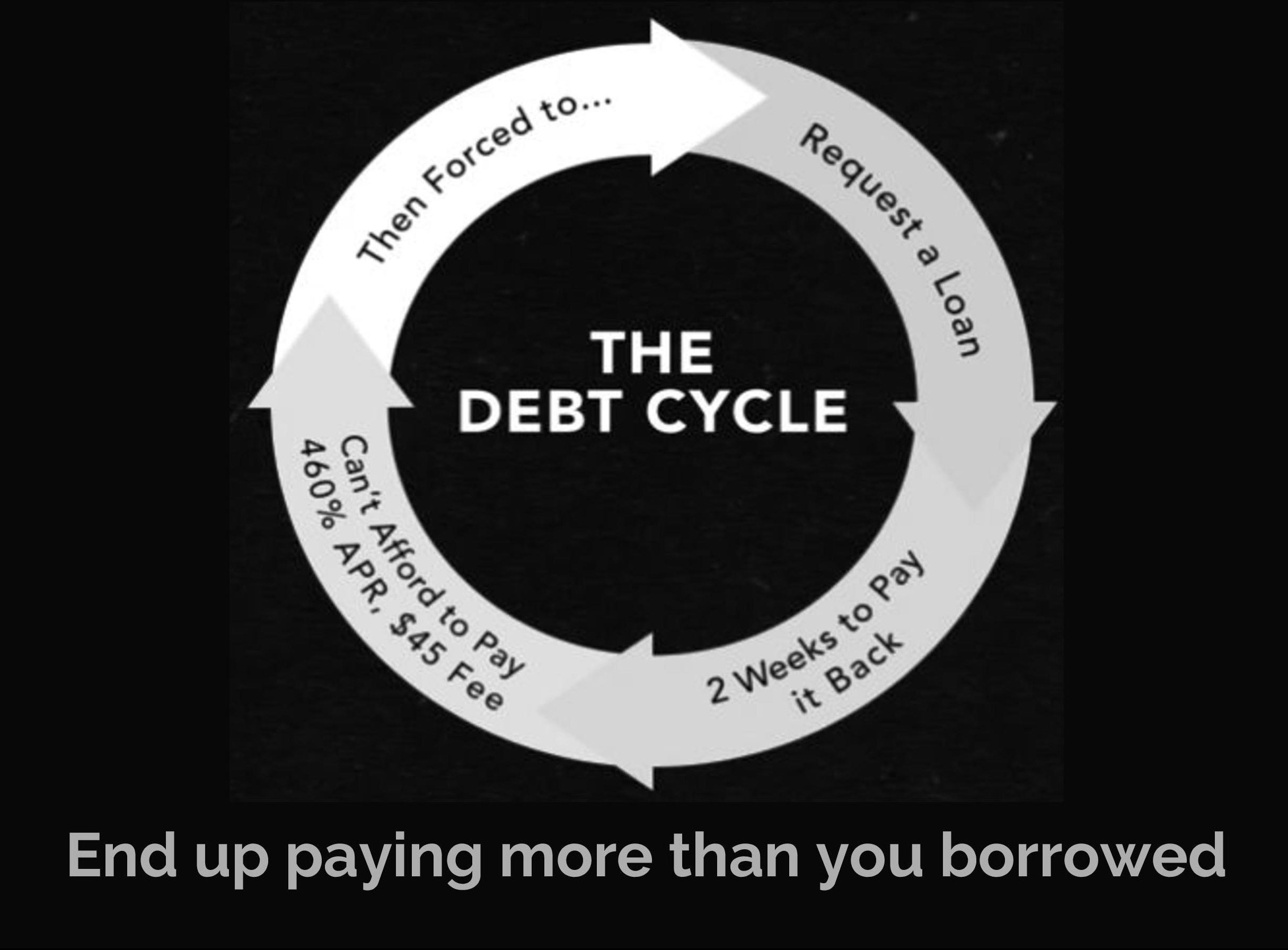

And the tough area is actually education loan obligations, because it’s difficult to get regarding. So-like, once again, such as i returned to your casing drama within the 2007 and 2008. For those who made a blunder and you will borrowed this home, it is far from higher; these are typically likely to foreclose, and you also get rid of our home, however, then, the brand new situation’s style of complete, right? Not high, but it’s done.

And so when you cannot pay their student education loans, it initiate garnishing your earnings, might take your social shelter commission if you wait until senior years, might capture disability money regarding the regulators, he’s got plenty of recourse since it is the government to simply do things immediately.

Therefore continues to snowball inside years that will get more challenging and you can more challenging to leave away from since it is just constantly coming at the all of them. And therefore you to definitely bottom ten% is really what is not able to pay it back.

Now, offered, once again, there’s a big majority that simply doesn’t want to have them. Because payday loans Murray, CT it is an encumbrance and it also really does keep people about. But on the flip side, it is a financial investment, and you can hopefully, you could begin improving those individuals income to make it to a place where you are able to pay them.

There is reasons for that job losses; it is a top quantity of student loan personal debt such as for example lifetime did not exercise because planned, and i also is also esteem one, right?

SHERYL: Many thanks for you to. That is helpful to see. You really have a great amount of resources, and i also is training that some of the resources are on the way to pay-off student obligations. And so i would like you to generally share among those tips your provides so they are able visit your website in addition they find them.

ROBERT: Yeah, if you see thecollegeinvestor, you will find it there and the education loan personal debt case. And we features plenty of indicates; the thing that we are not aware with college student loan financial obligation would be the fact there are a great number of repayment bundle options, and some of them are income-passionate.